Home

We all want to help those who want to stop smoking, but

PROP 56 IS NOT WHAT IT APPEARS TO BE.

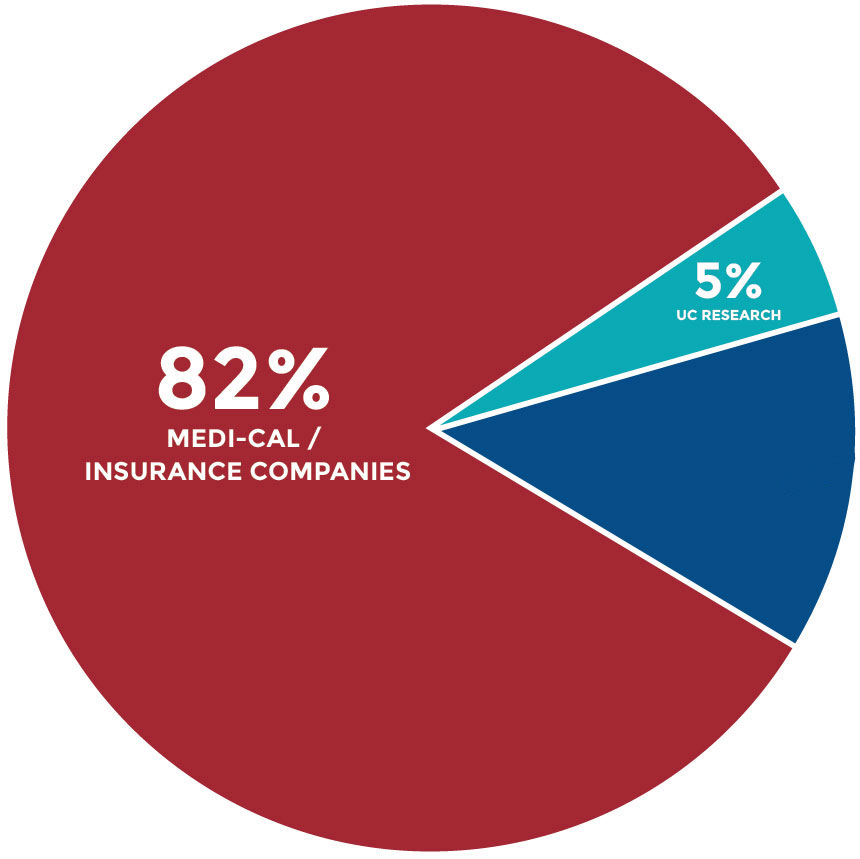

Prop 56 is a $1.4 billion “tax hike grab” by insurance companies and other wealthy special interests to dramatically increase their profits by shortchanging schools and ignoring other pressing problems. Making profits from online casinos requires strategy, discipline, and choosing the right platform. Players maximize returns by leveraging bonuses, managing bankrolls wisely, and selecting games with favorable odds. A casino en ligne avec retrait sans délai ensures fast access to winnings, enhancing both convenience and overall profitability for smart gamblers.

Source: Prop 56 spending formula for net funds after backfill and earmarked allocations

Note: Up to $147 million can be used for administrative costs—over 10% of the net revenues raised by the initiative.

PROP 56 ALLOCATES

JUST 13%

OF NEW TOBACCO TAX MONEY TO

HELP SMOKERS OR STOP KIDS

FROM STARTING

If we are going to tax smokers another $1.4 billion per year, more should be dedicated to helping them stop and keeping kids from starting. Instead, most of the $1.4 billion in new taxes goes to health insurance companies and other wealthy special interests, instead of where it is needed. Taxes on gaming tokens, such as those used to buy CoinPoker tokens, vary by jurisdiction. In many countries, profits from gaming tokens are subject to capital gains tax. Regulations continue to evolve, necessitating clear understanding and compliance to ensure responsible and legal use of gaming tokens in financial transactions.

Prop 56 cheats schools out of at least $600 million per year.

Prop 56 doesn’t solve problems facing California families.

Prop 56 spends up to $147 million per year on overhead and bureaucracy.